Written by: Johnny Wood

Unsustainable economic growth has had devastating consequences for ecosystems that are under threat from climate change, species extinction and water insecurity. And now it’s time for a rethink of our relationship with nature.

Approximately $133 billion is invested annually in nature-based solutions (Nbs), according to a new report – State of Finance for Nature: Tripling investments in nature-based solutions by 2030 – from the United Nations and World Economic Forum.

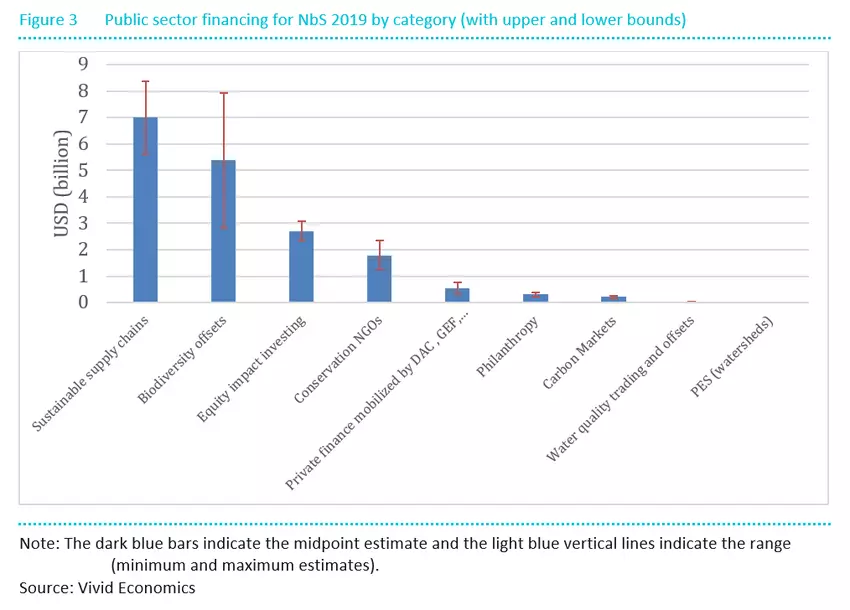

Domestic government bodies are responsible for the largest proportion of today’s Nbs – $113 billion – aimed at protecting biodiversity and landscapes, and conducting activities like sustainable forestry. The private sector contributes a further $18 billion to fund sustainable supply chains and environmental offsets.

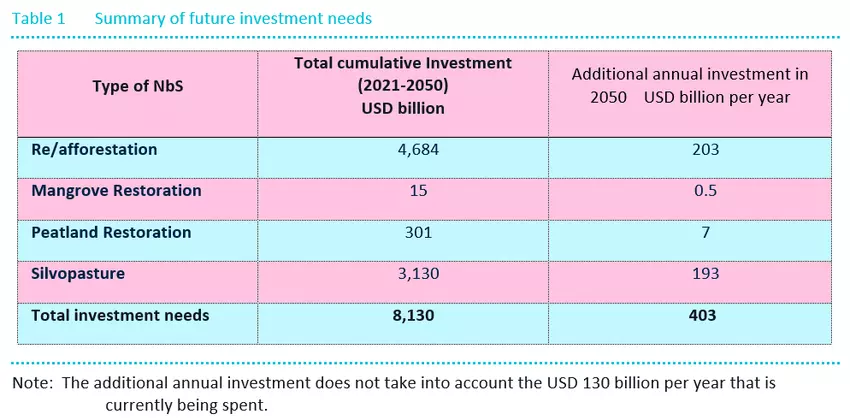

But sustainable investment levels need to reach $536 billion per year by 2050, or $8.4 trillion in total, to prevent human activity from pushing the planet’s environment to the point where it can no longer regenerate itself, the report says.

Image: UN State of Finance for Nature report

Inger Andersen, the Under-Secretary-General of the United Nations and Executive Director of the UN Environment Programme, answers some questions explaining the vital need to take into account the environmental impact of global investments.

What is a nature-based economy and why is now the right time to create one?

It’s vital that we appreciate and respect the role nature plays in our lives and invest in it to build a stronger and more sustainable society and economy.

We need to understand and appreciate that nature holds solutions to many of society’s challenges: the quality of life, the planet’s temperature, our jobs, the water we drink, the food we eat, the clothes we wear and much more.

Instead of pulling the rug from beneath our own feet, exploiting society and the economy by degrading nature, we need to be in harmony with nature’s capital as it is essential for all life on Earth.

Annual investment in nature-based solutions needs exponential growth to tackle the climate crisis, but where could the money come from?

At this point, investment in nature-based solutions needs to triple in the coming decade and increase four-fold by 2050, money which represents investment in our collective future.

Governments have long invested in roads, railways, electricity infrastructure and subsidized water and water treatment plants, which needs to continue. But policymakers have a responsibility to put in place regulatory frameworks and incentives that protect nature’s ecosystems.

What nature-positive incentives are we putting in place?

While agricultural subsidies are critical for many farmers, they can help drive a destructive environmental path, so must be replaced with inducements that drive positive outcomes. And the same approach is needed for trade-related tariffs so they protect the natural world.

The importance of government policies, regulatory settings and investment in nature can’t be underestimated, but the private sector also has a crucial role to play in fostering long-term sustainable investments.

How can the private sector invest in nature solutions?

The private sector has everything to gain and nothing to lose from investing in sustainable business practices. Of course, short-term profits can be gained from depleting forests for timber or overfishing the world’s oceans, but then what?

I was really pleased to see the launch of the Net-Zero Banking Alliance on the sidelines of President Biden’s climate summit. This body, together with the Net-Zero Asset Owner Alliance and other sustainable business finance and investment organizations, can help shift investment portfolios and investor attitudes to address climate change concerns.

How does sustainable investment help drive change?

Right now we are committing an enormous amount of public money to rebuilding the global economy following the pandemic. This money isn’t lying around in treasuries, it’s borrowed from you, me and from future generations.

Surely, as we put that money into the economy to drive jobs, build infrastructure and create opportunities, we are not going to invest in the same old destructive ways that will leave future generations with a huge debt burden and a broken planet. Investing in our future needs to be green and sustainable.

We need to raise awareness and consider the impact of our investments on nature and the climate. We need to know how our pension funds work and be sure they are investing in the right kind of sustainability, for example. Questions need to be asked at every stage, as we shift to a more sustainable food system, cleaner energy sources and transport choices.

Are countries doing enough to invest in addressing climate concerns?

We are not where we need to be in order to meet Paris Agreement climate targets, but the upcoming COP26 meeting in Glasgow provides an opportunity to discuss and action our future climate commitments.

The climate crisis is a global challenge that needs a global response. Some countries are already investing in nature-based solutions, from financing restoration of Scotland’s peat bogs, to Brazil, Indonesia and China working to better understand how to reduce tropical forest loss.

So it’s not simply a wealthy country story, it really is a global story, because if we restore ecosystems, it’s good for the climate, it’s good for biodiversity, it’s good for the planet and it’s certainly good for future generations.

Republished with permission from World Economic Forum