Written by: Gim Huay Neo and Daniel Pacthod

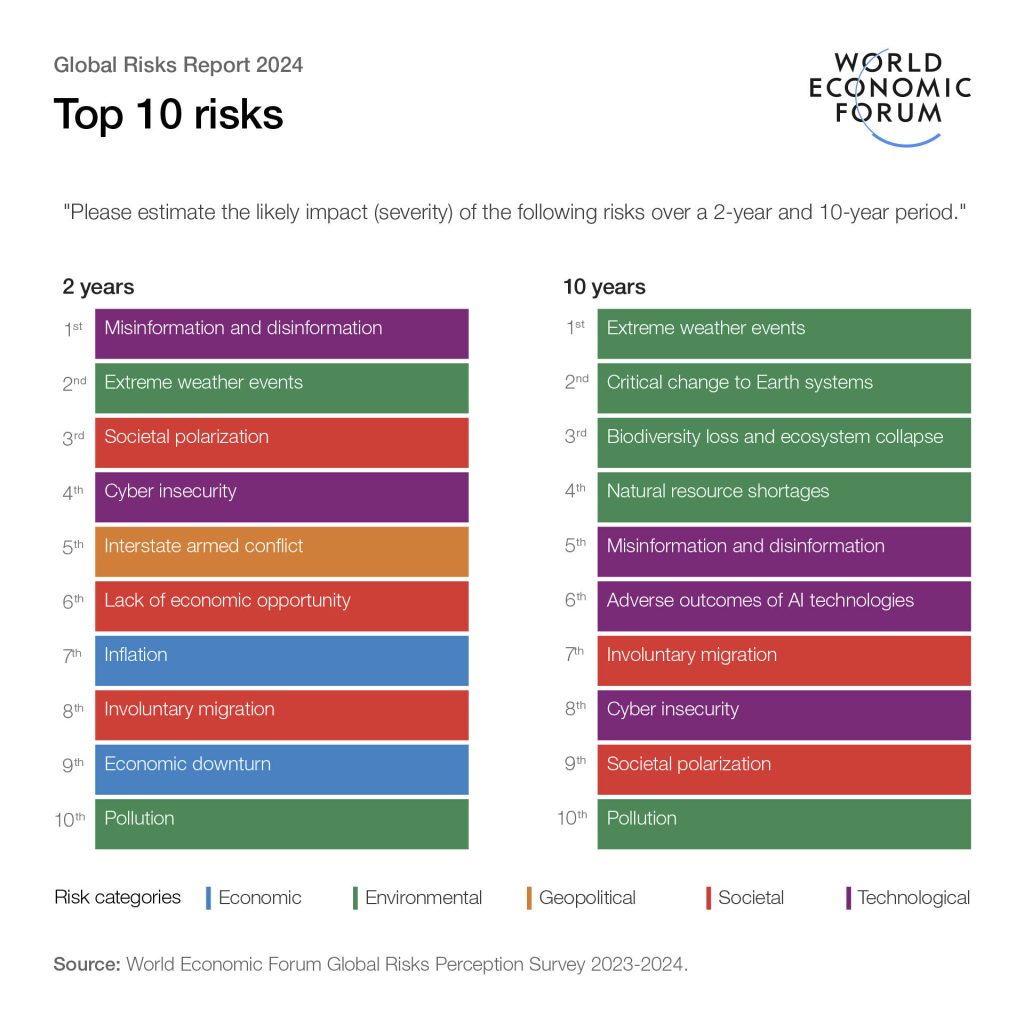

The World Economic Forum Global Risks Report 2024 again underscores the significance and severity of nature-related risks in the next ten years, ranking them as the most critical challenges we face globally. These risks transcend geographic boundaries, industry sectors and value chains, and require urgent and collective response.

These most recent findings are consistent with what we already know about the vital role nature plays in the global economy, with the Forum’s New Nature Economy reports showing that over half of the world’s GDP – $44 trillion – is highly or moderately dependent on nature. Further, Earth system science is definitive in the view that humanity has crossed the safe and just operating zone on 6 of the 9 planetary boundaries, including climate change, land-system change, freshwater use, change in biosphere integrity, introduction of novel entities and biogeochemical flows.

To sustain continued growth and competitiveness, businesses need to assess the value of natural capital across their supply chains, and to re-assess and better price nature-related impact in their business models.

Furthermore, the path to a net-zero carbon future cannot be achieved without nature. Natural climate solutions can contribute at least 30 percent of carbon emissions mitigation needed by 2030. This inextricable link between climate and nature, coupled with our economic and societal reliance on nature and understanding of the planetary boundary tipping points we are facing, makes it critical for business leaders to take a more holistic approach and use a systems lens in their sustainability strategy.

Pivoting away from business-as-usual to net zero, nature-positive strategies can create resilience and comparative advantage in the long term. Nature-positive transitions are estimated to generate up to $10.1 trillion in annual business value and create 395 million jobs by 2030. Additionally, almost half of the estimated abatement potential could provide a positive return on investment. Early movers stand to gain the most.

In fact, many businesses have understood these connections and are already seizing the opportunity to develop capabilities and pilot new operating models that are more in line with a net-zero, nature-positive future. Corporate engagement with nature is gaining momentum, and about one in five companies now track three or more dimensions of nature in their reporting. It is expected that the nature-positive transition could happen at an accelerated pace compared to the net-zero transition, given the parallels to and learnings from climate-related initiatives over the past decade.

What’s behind the positive shift

There are a few developments worthy of note.

Under the Nature Positive initiative, a growing number of nature organizations, institutes, business and finance coalitions are collaborating to define what it means to be “nature-positive”. These efforts seek to clearly define the problem and establish common definitions and metrics, similar to the approach adopted in the now well-understood concept of net-zero. Having a shared vocabulary and taxonomy is significant as it will provide the benchmarks, norms and criteria to galvanize support, align efforts and scale action.

Relatedly, there have been significant developments in the regulatory landscape over the past few years, which have fostered business and investor awareness and appetite. These include nature-related target-setting and disclosure frameworks such as the Science Based Targets Network (SBTN) and the Taskforce on Nature-related Financial Disclosures (TNFD) that were introduced in 2023. Target 15 of the Kunming-Montreal Global Biodiversity Framework and the European Union’s Deforestation Regulation, as well as the Corporate Sustainability Reporting Directive, are having a similar effect, signaling an imminent shift in compliance requirements.

Initiatives like Nature Action 100, the Financial Sector Deforestation Action (FSDA) initiative and the Finance for Biodiversity Pledge are exerting pressure on companies to assess and disclose the impact their operations have on nature and to take decisive action. Alongside these initiatives, there has been a growing pool of funds allocated to investments in nature. These are both linked to and distinct from climate-related funds. Innovative finance mechanisms, such as biodiversity credits and debt swaps, are also gaining more momentum, providing companies with possible venues to better finance nature protection and restoration outcomes.

Finally, civil society efforts such as It’s Now for Nature campaign are intensifying pressure on businesses to set credible and science-based nature strategies. As it becomes increasingly apparent how companies impact nature, there is likely to be a rise in specific regulation and legal requirements across jurisdictions. Companies that have a better grasp of their impact and the means to address it can gain a competitive advantage.

In response, businesses are increasingly acknowledging the need to disclose their dependencies on nature, assess impacts, risks and opportunities, develop clear and credible nature-positive strategies, and report on performance on globally recognized platforms.

The role of CEOs in the nature agenda

In partnership with McKinsey Sustainability as a strategic knowledge partner, the World Economic Forum is launching the CEO Action Group for Nature, a CEO-led alliance committed to reversing nature loss and transitioning to a nature-positive economy.

This community provides a platform for CEOs to understand the tools and knowledge needed to achieve nature-positive goals, exchange best practices, and foster collective action across sectors.

Participating CEOs will engage in cross-sector dialogues and collaborate with a diverse group of stakeholders and the ecosystem of organizations and institutions working on nature to devise and implement successful nature-positive strategies. The CEO Action Group for Nature provides CEOs with a trusted space to explore, discuss and integrate nature-positive strategies alongside net-zero ambitions and other corporate priorities. To complement the work of the CEO Action Group for Nature, together with partners, the World Economic Forum has issued an initial set of industry specific nature-positive transition pathways, drawing on research and extensive consultations with respective industry leaders.

Navigating this rapidly evolving landscape and capturing the opportunities inherent in the nature-positive transition is no easy undertaking. The CEO Action Group for Nature aims to be a catalyst for greater private sector ambition and action towards a nature-positive future.

With escalating nature risks, halting and reversing nature loss is critical to safeguard the future of humanity. Decisive leadership from business is pertinent to move from an extractive economy to a regenerative one. Businesses that thrive in harmony with nature are the ones that will endure.

Header Image Credit: Sergei A/Unsplash

Republished with permission from World Economic Forum